Case Study 1: How to apply loans for a better Real Estate Investment ?

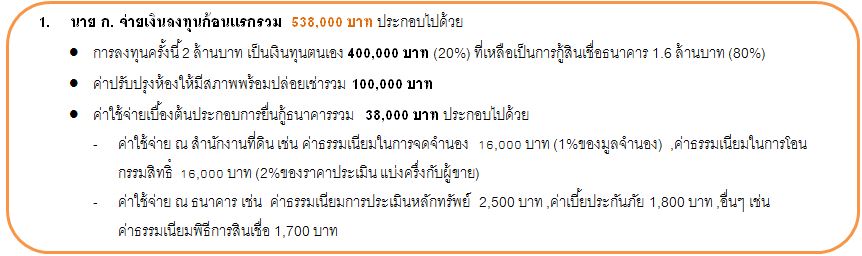

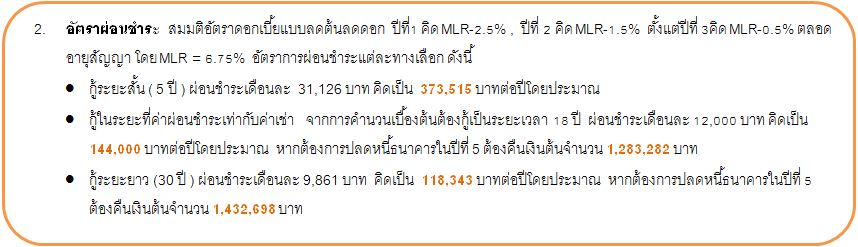

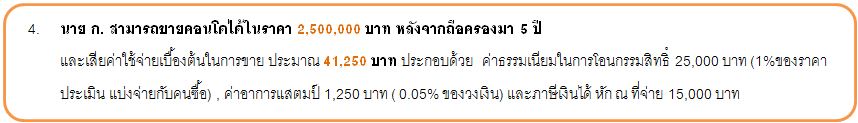

In the present, there’re so many of those who interest to invest in real estate. Some need to apply a loan from banks because their capital isn’t enough to invest whereas some willing to apply a loan from bank although they have financial readiness. It seems loan application have some implications that more important than other financial transactions. For real estate investment whether pre-owned house, condo or townhouse, to gain returns in the type of rents which called, “Passive income”, there’s a keyword that you have to consider is, “Cash flow” that indicate to cash gaining and spending or cash equivalents of company or person who invested. Cash that flow into company is consider as income called, ”Cash flow in” and cash that flow out from company is considered as expenditures called, “Cash flow out”. So, loan application is a one of factors that affect to cash flow in investment absolutely. TerraBKK Research is going to explain simply by sample situation that possible to happen in real life as follow: "Mr. John is interested to invest in pre-owned condominium that quite old in area of Ratchada – Huai Khwang in the price about 2 MB to rent out 12,000 baht/month and intend to sell it after possess for 5 years. Mr. John doesn’t have the enough capital. So, he will consider about 3 choices before loan application as below 1. Short-term loan (5 years) lowest interest rate but monthly installment is high. 2. Loan that has monthly installment equal rents 3. Long-term loan (30 years) has low monthly installment rate and get difference but high interest To make explanation focus on difference of 3 choices, have to control other details to make them on the same way as below (all are assumed numbers that may differ from real)

TerraBKK Research is going to explain as a chart below

TerraBKK Research is going to explain as a chart below  According to chart, you may decide to choose the first choice because of highest net cash flow, but you have to take your own capital to pay installment in full amount whereas 2nd and 3rd choices are not due. So, you can take the money that you’ve got from condo to release the debt by you don’t have to use your own capital as 1st choice. So, TerraBKK Research willing to recommend “Mr. John” that you shouldn’t look at final returns only, you should emphasize financial investment estimation by financial ratio for decision. For this case, Mr. John uses IRR (Internal rate of return) to indicate returns rate from investment. You will found that IRR is increasing if borrow in long term. So, you should choose 3rd choice and to gain the highest returns from investment, you should consider with ROE (Return on Equity) that investment capital (your capital only) can make profit more or less that you will see ROE in 2nd, 3rd choices are higher than 1st choice over twice whereas 2nd choice will be different from 3rd choice not so much. All these indicate that to apply long term loan has a part to make you get more returns from investment more than short term loan because it is consideration of investment capital ratio truly Finally Terra Research TerraBKK Research recommends that to borrow from banks seems to be taking profit from others’ capital which called, "OPM (Other People's money)”. Although it reduces your own investment capital ratio, it can be a double- edged sword too. If there’s a case that you don’t have any tenant, not only investors don’t get any returns, but investors also have to bear a burden of all capital and interests. It can transform income into expenditure. Therefore, you have to understand information in-depth and decide carefully before invest.

According to chart, you may decide to choose the first choice because of highest net cash flow, but you have to take your own capital to pay installment in full amount whereas 2nd and 3rd choices are not due. So, you can take the money that you’ve got from condo to release the debt by you don’t have to use your own capital as 1st choice. So, TerraBKK Research willing to recommend “Mr. John” that you shouldn’t look at final returns only, you should emphasize financial investment estimation by financial ratio for decision. For this case, Mr. John uses IRR (Internal rate of return) to indicate returns rate from investment. You will found that IRR is increasing if borrow in long term. So, you should choose 3rd choice and to gain the highest returns from investment, you should consider with ROE (Return on Equity) that investment capital (your capital only) can make profit more or less that you will see ROE in 2nd, 3rd choices are higher than 1st choice over twice whereas 2nd choice will be different from 3rd choice not so much. All these indicate that to apply long term loan has a part to make you get more returns from investment more than short term loan because it is consideration of investment capital ratio truly Finally Terra Research TerraBKK Research recommends that to borrow from banks seems to be taking profit from others’ capital which called, "OPM (Other People's money)”. Although it reduces your own investment capital ratio, it can be a double- edged sword too. If there’s a case that you don’t have any tenant, not only investors don’t get any returns, but investors also have to bear a burden of all capital and interests. It can transform income into expenditure. Therefore, you have to understand information in-depth and decide carefully before invest.  Other case studies >Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ? >Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า? >Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ >Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย >Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ? >Case Study 4 : ดับฝัน! First Jobber เป็นเจ้าของคอนโดฯแทนเช่าหอพัก >Case Study 3 : "เช่าซื้อบ้าน" ทางออกของผู้มีรายได้น้อย >Case Study 2 : ซื้อบ้านเพื่ออยู่อาศัย ควรขอสินเชื่ออย่างไร ?

Other case studies >Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ? >Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า? >Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ >Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย >Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ? >Case Study 4 : ดับฝัน! First Jobber เป็นเจ้าของคอนโดฯแทนเช่าหอพัก >Case Study 3 : "เช่าซื้อบ้าน" ทางออกของผู้มีรายได้น้อย >Case Study 2 : ซื้อบ้านเพื่ออยู่อาศัย ควรขอสินเชื่ออย่างไร ?