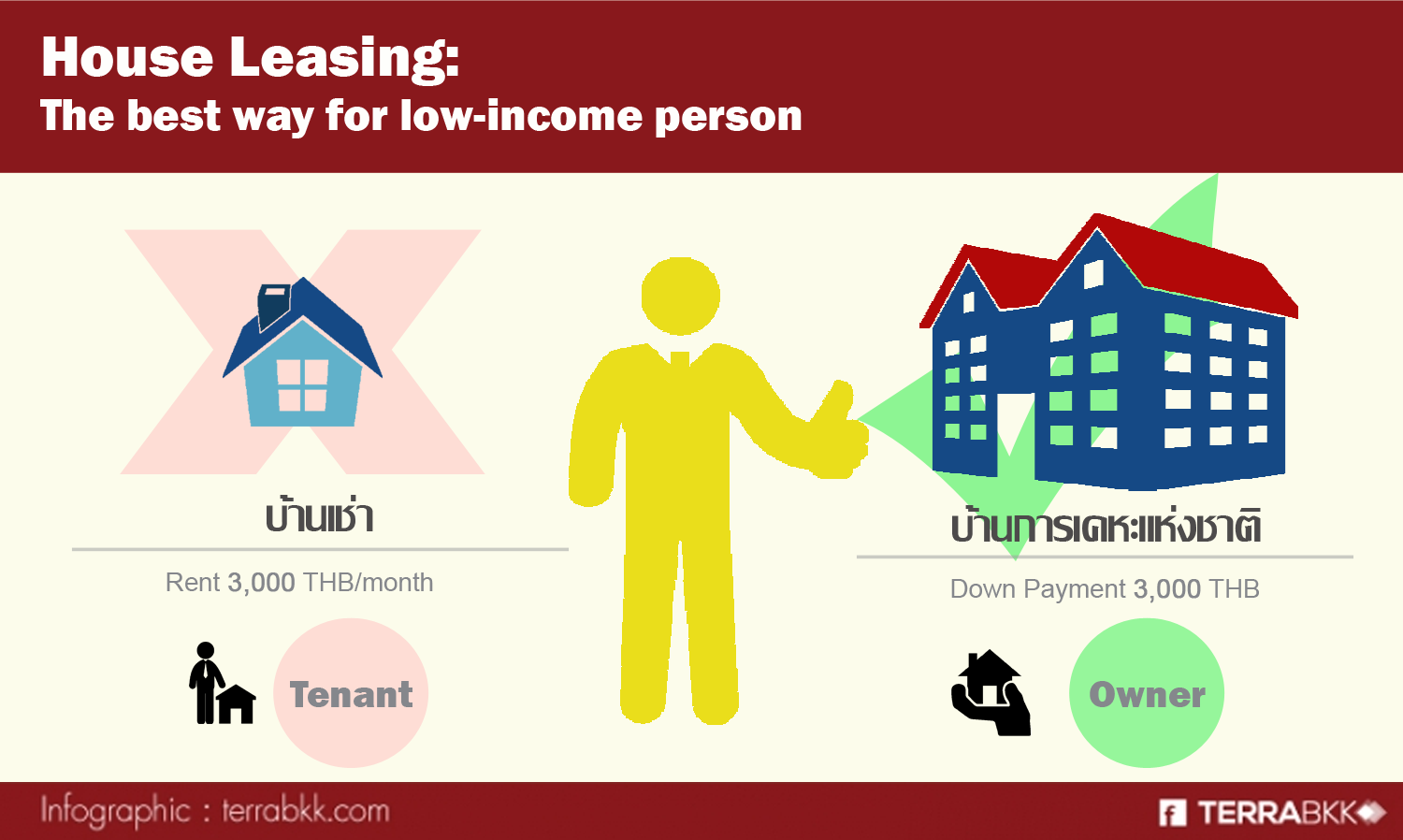

Case Study 3 : Hire-purchase , the best way for low-income person

“Home” seems refer to proud, asset, and debt at the same time because home is the thing that may indicate to wealth of person. However, it makes disappointment to low income persons because it’s hard to buy a home with their income. So, they have to pay a rent to live in rental home. Some entrepreneurs see an opportunity in the market that has the group of low-income clients. “Installment cheaper than rent” one of advertising slogan which many people has heard is one of marketing strategy to persuade clients that have low income and don’t have their own houses and want to have their own houses but house projects which entrepreneurs offer have price about more than 1 million baht. Clients must have eligibility and ability to borrow from bank in the case of their capital is not enough. So, people who have low-income cannot make their dreams come true with any house project. TerraBKK Research TerraBKK Research has an idea that the best way for low-income person is “Hire-purchase contract” TerraBKK Research has an idea that the best way for low-income person is “Hire-purchase contract” that is the contract between landlord and renter. Landlord allow renter to live and commit to sell such asset or give the right over such asset belong to renter by the condition that renter pay by term which agreed. This type of contract can be found in National Housing Authority in purchasing Eua-Arthorn housing project and Community Housing Project which are projects that answer the need of low income person directly. Making contract of hire-purchase contract seems like financing for these clients groups that don’t have ability to borrow from financial institutions. For easier understanding, TerraBKK research would like to present you with a case study "House hire-purchase in Thailand of National Housing Authority" as follow: “ Mr. Somwang is 30 years old, motorcycle taxi rider, live in rental house 3000 baht/month, and want to have his own house”. Mr. Somwang studies the information of house hire-purchase and found the information as below:

- House hire-purchase can do by every occupation, doesn’t need salary slip, co borrowing and may borrowing 100% of asset price.

- Eligibility of contractor includes have a Thai nationality, reached the legal age, don’t bankrupt/blacklisted and have a family income not over 30,000 baht/month.

- Conditions in hire-purchase contract such as pay reservation charge in contract making only 3,000 – 6,000 baht. When you got a right, you have to pay installment of down payment during construction 300 baht/month for showing that you really want to buy this asset and have ability to pay installment.

- You can found the project in every region of Thailand that has two types of housing such as 22 sq.w detached house, starting price 390,000 baht and condominium that has starting price by usage space such as Ao Ngoen community housing, 31 sq.m, starting price is 289,000 baht.

- Able to contact by go to sale office directly and internet http://dhds.nha.co.th/nhasales/newmainrentsale.aspx

Finally, TerraBKK Research has a saying that Having your own real estate is the good thing but you should to be live moderately, don’t buy a house that over your ability and have financial discipline *More information National Housing Authority More case study articles >Case Study 9 : อสังหาฯของคุณ ทรัพย์สิน หรือ หนี้สิน กันแน่ ? >Case Study 8 : สำหรับ First Jobber คิดอย่างไรให้การซื้อคอนโดคุ้มกว่าการเช่า? >Case Study 7 : เหตุผลที่คนรวยซื้ออสังหาฯ >Case Study 6 : Cut Loss !! ตัดใจขายทิ้ง เมื่อเก็บอสังหาฯไว้ มีแต่รายจ่าย >Case Study 5 : รายได้เท่าเดิม อยากซื้ออสังหาริมทรัพย์ที่แพงกว่า ควรทำอย่างไร ? >Case Study 4 : ดับฝัน! First Jobber เป็นเจ้าของคอนโดฯแทนเช่าหอพัก >Case Study 2 : ซื้อบ้านเพื่ออยู่อาศัย ควรขอสินเชื่ออย่างไร ? >Case Study 1 : ลงทุนอสังหา ต้องกู้สินเชื่ออย่างไร ?