TerraBKK Research update Operating Result of Construction Service in 1H2015.

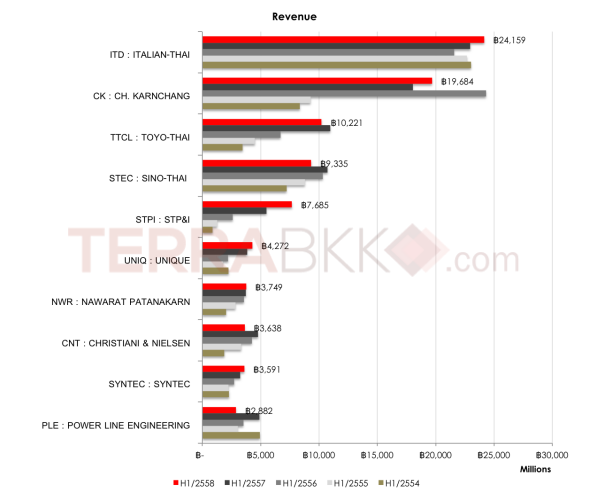

Overall in 1H2015 income tend to increase but the profitability may reduce. The Company that grew both income and yield were STPI (installation of steel structures and construction of large industrial); UNIQ (provides a full range of both design and construction); SYNTEC (construction and mechanical jobs).

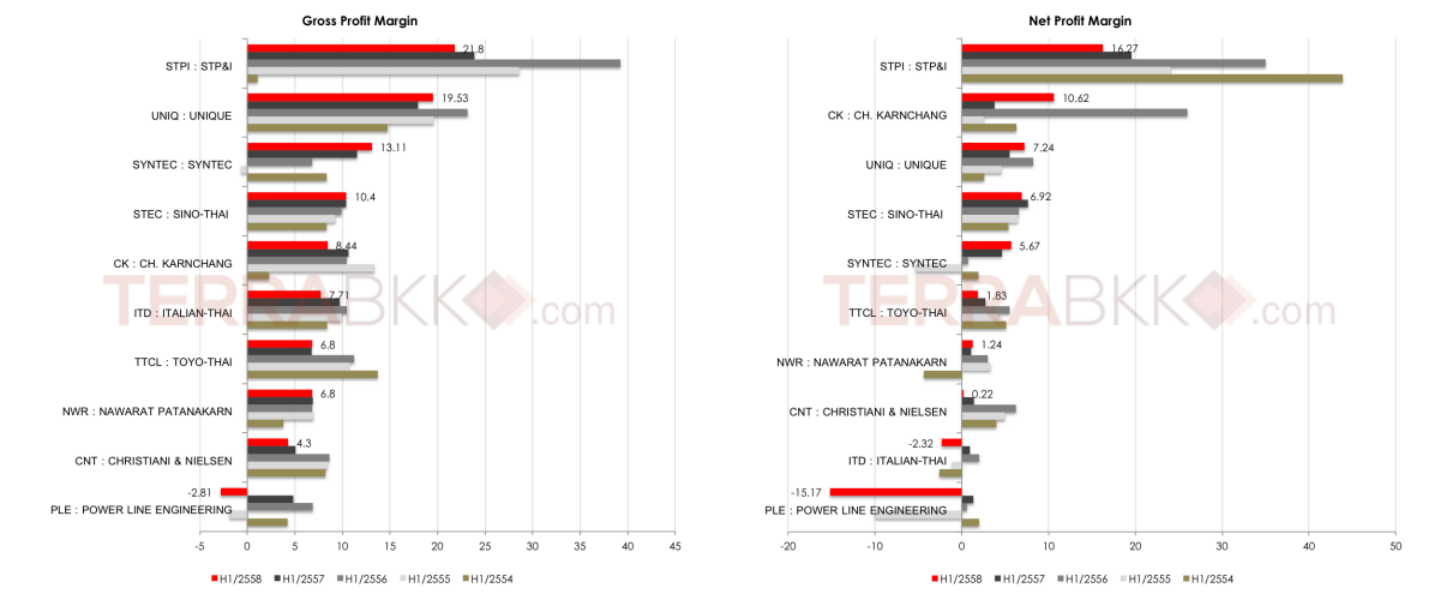

Gross Profit Margin, The Company with the highest gross profit margin is still STPI (5 consecutive champions), although the Gross Profit Margin in this year is decreased 21.8% Y-o-Y, but still high compared to other companies in the sector. The companies that Gross Profit Margin will continue to steadily increase is UNIQ, SYNTEC, and STEC.

Net Profit Margin, STPI is a company that has the highest net profit margin at 16.27%. This was followed by CK with 10.62%, UNIQ with 7.24%.

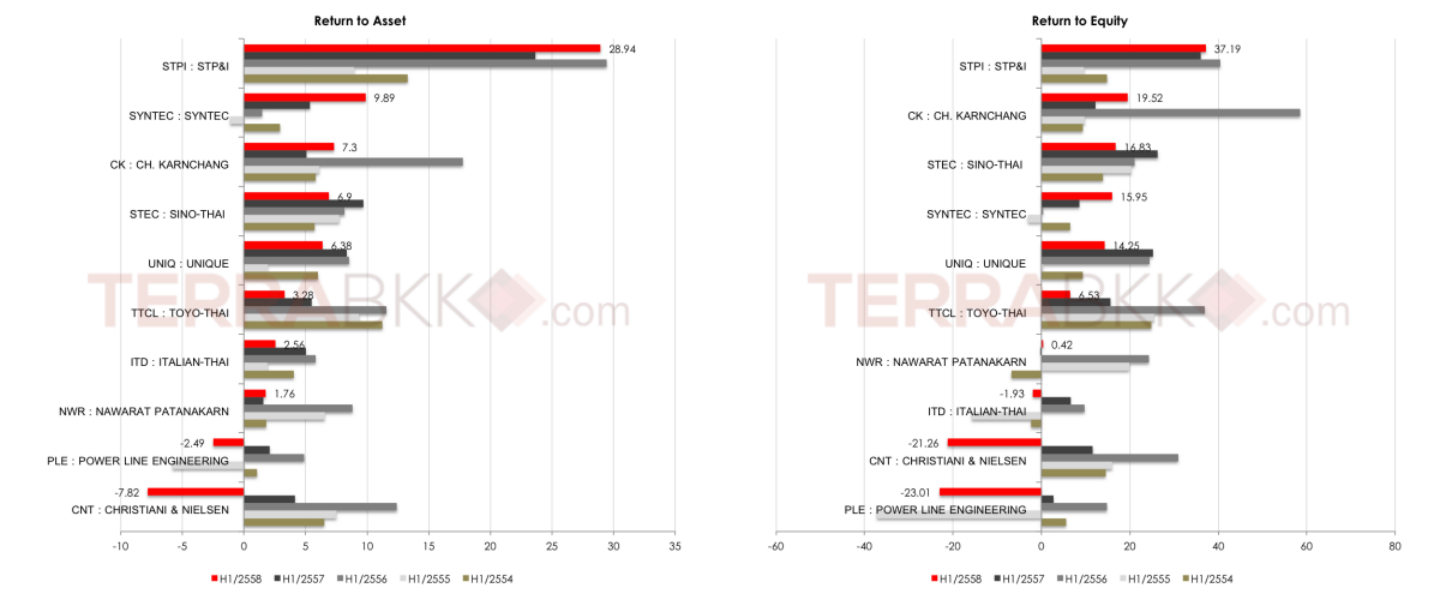

Return on Assets (ROA) represents the ability to utilize the resources effectively. STPI achieved the highest ROA ratio at 28.94%, but other companies have ROA ratio lower than 10%.

Return on Equity (ROE) is a profitability ratio that measures the ability of a firm to generate profits from its shareholders investments in the company. STPI achieved the highest ROE ratio at 37.19%. This was followed by CK with 19.52%, STEC with 16.83% and SYNTEC with 15.95%, but SYNTEC is only one that ROE increased strongly.

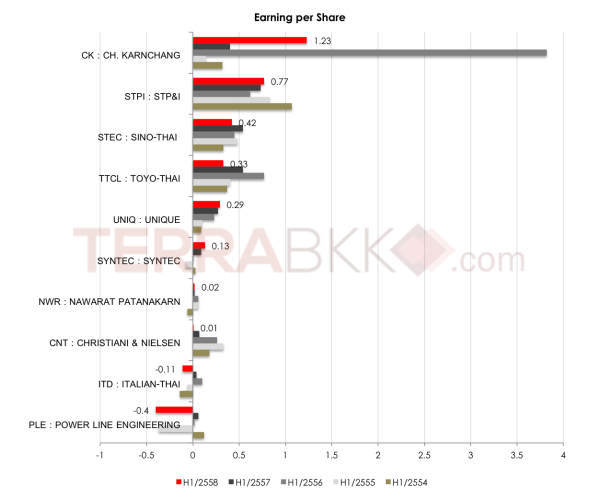

Earning per share (EPS) is a market prospect ratio that measures the amount of net income earned per share of stock outstanding. CK achieved the highest growth at +207.5% (Y-o-Y). This was followed by SYNTEC with +44.44% (Y-o-Y), UNIQ with +7.41% (Y-o-Y) and STPI with +5.48% (Y-o-Y).

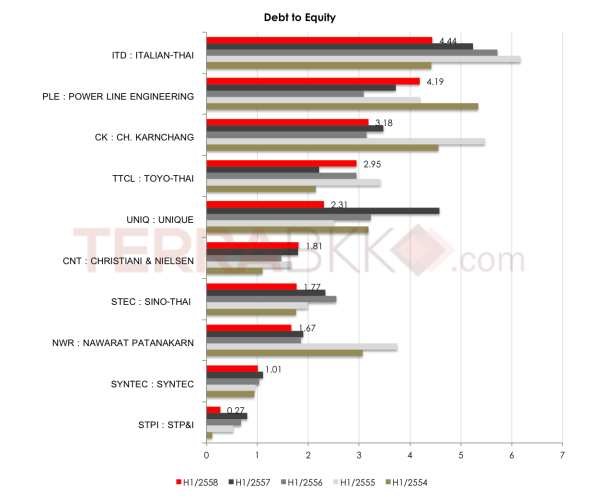

Debt to equity ratio is a financial, liquidity ratio that compares a company's total debt to total equity. For most companies the maximum acceptable debt-to-equity ratio is 1.5-2 and less. The company has a debt to equity ratio of less than 2: STPI, SYNTEC, NWR, STEC, and CNT - เทอร์ร่า บีเคเค

บทความโดย : TerraBKK ข่าวอสังหาฯ แหล่งข้อมูล : ตลาดหลักทรัพย์แห่งประเทศไทย TerraBKK ค้นหาบ้านดี คุ้มค่า ราคาถูก