PropertyGuru Reports First Quarter 2023 Results

- Total revenues grew 16% to S$33 million in the first quarter 2023, with over 25% year over year growth in every segment except Vietnam

- The Company reaffirms its full year 2023 outlook for revenue of S$160 million to S$170 million and Adjusted EBITDA of S$11 million to S$15 million

PropertyGuru Group Limited (NYSE: PGRU) (“PropertyGuru” or the “Company”), Southeast Asia’s leading[1], property technology (“PropTech”) company, today announced financial results for the quarter ended March 31, 2023. Revenue of S$33 million in the first quarter 2023 increased 16% year over year. Net loss was S$10 million in the first quarter and Adjusted EBITDA[2] was a positive S$0.2 million. This compares to a net loss of S$120 million[3] and a positive Adjusted EBITDA of S$0.5 million in the first quarter of 2022.

Management Commentary

Hari V. Krishnan, Chief Executive Officer and Managing Director, said “Our first quarter results are a successful start to 2023. As expected, performance in Singapore and Malaysia helped offset the challenging market conditions in Vietnam. In Singapore, our solutions performed well, effectively monetizing the strong sales market as well as taking advantage of rising rental rates. Malaysia continues to benefit from newly launched products and further execution of our dual brand strategy. Vietnam remains the primary challenge in the near-term, as governmental monetary policy has significantly impacted real estate transaction activity. We believe that these pressures will begin to abate in the latter part of 2023 and into 2024. We continue to proactively manage our operations to maximize performance while laying the groundwork to take advantage when the Vietnam real estate market recovers. In all of our markets, we are often reminded that the value of PropertyGuru solutions for our customers can be more visible when the property cycle transitions and macro-economic pressures intensify.

As we move into the middle of 2023, we remain positive in both our ability to deliver essential, differentiated property solutions to our agent and enterprise customers as well as the long-term health and opportunity that is characteristic of our Southeast Asian property markets. In the following quarters, we will be focused on helping consumers find, finance, and own their homes. We continue to be excited about the fundamental opportunities available in the markets we operate in.”

Joe Dische, Chief Financial Officer, added “We are pleased with the 16% year over year revenue growth in the first quarter of 2023. The year has started off strongly despite the anticipated challenges in Vietnam due to monetary policy actions by the government in a targeted effort to cool real estate market activity. Given macro uncertainty, we continue to keep a close eye on costs, especially with respect to discretionary spending. Our Adjusted EBITDA this quarter was in-line with the first quarter of 2022 despite the inclusion of a full quarter of costs associated with being a listed entity. We remain confident in the underlying strength of our offerings and the opportunities in the Southeast Asian property markets. As a result, we are reaffirming our 2023 full year financial outlook for both revenue and Adjusted EBITDA. Lastly, we are encouraged by the types of strategic M&A opportunities we are seeing in the marketplace as we continue to explore and evaluate adjacent opportunities to deploy available capital.”

Financial Highlights – First Quarter 2023

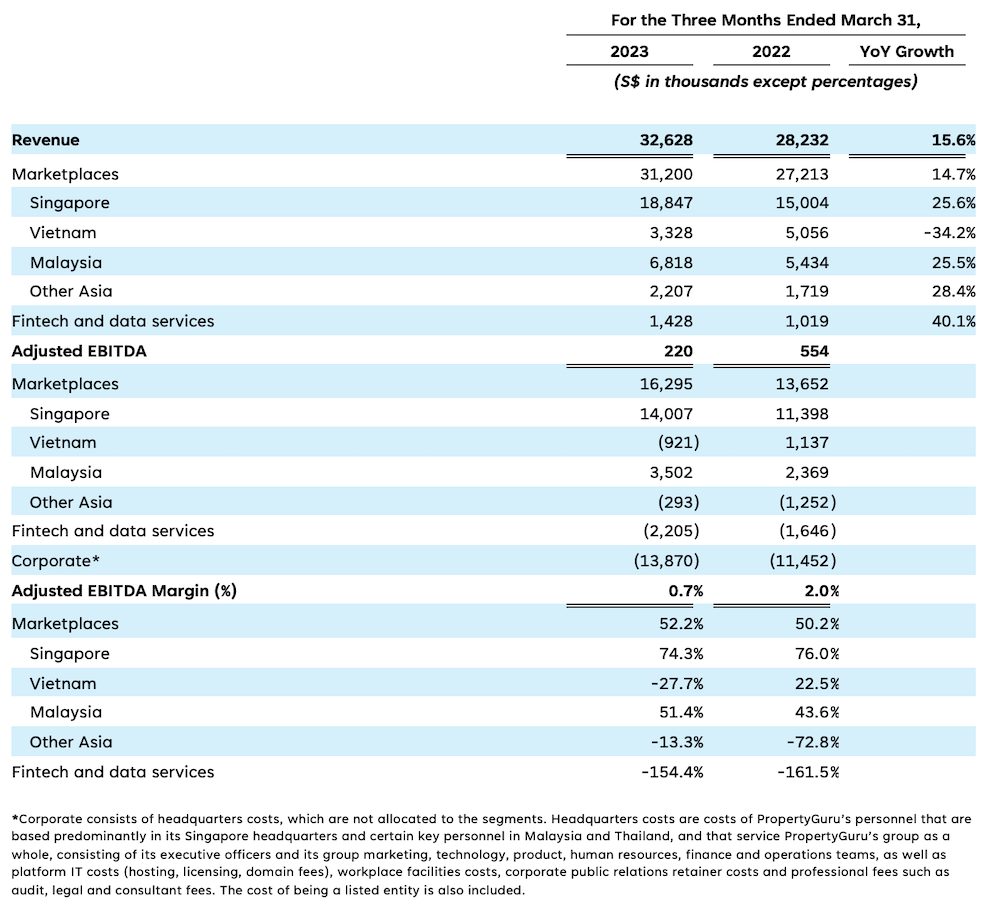

- Total revenues increased 16% year over year to S$33 million in the first quarter.

- Marketplaces revenues increased 15% year over year to S$31 million in the first quarter, as continued strength in Singapore and Malaysia offset challenges in the Vietnam market due to governmental restrictions on credit.

- Revenue by segments:

o Singapore Marketplaces revenue increased 26% year over year to S$19 million, as the number of overall agents and the Average Revenue Per Agent (“ARPA”) grew in the quarter. Quarterly ARPA was up 19% in the first quarter to S$1,124 as compared to the prior year quarter and the number of overall agents in Singapore was up over 200 from year-end 2022 to 15,765 agents. The renewal rate was 79% in the quarter.

o Malaysia Marketplaces revenue increased 26% year over year to S$7 million, as the Company continues to leverage our two market leading brands (iProperty and PropertyGuru).

o Vietnam Marketplaces revenue decreased 34% year over year to S$3 million, as governmental actions to tighten credit continue to impact the overall number of listings in the market. The number of listings was down 32% to 1.1 million in the first quarter as compared to the prior year quarter. The average revenue per listing (“ARPL”) was S$2.95, in-line with the first quarter of 2022.

- At quarter-end, cash and cash equivalents were S$294 million.

Information regarding our operating segments is presented below. It is noted that in 2023 the Company is no longer removing the ongoing cost of being a listed entity when calculating Adjusted EBITDA. As such, the 2022 comparative has been restated.

Strong Category Leadership Drives Long-Term Growth Opportunities

As of March 31, 2023, PropertyGuru continued its Engagement Market Share[1] leadership in Singapore, Vietnam, Malaysia, and Thailand.

|

Singapore: 82% – 5.6x the closest peer |

|

Thailand: 54% – 2.2x the closest peer |

|

Vietnam: 83% – 5.1x the closest peer |

|

Indonesia: 26% – 0.4x the closest peer |

|

Malaysia: 93% – 13.9x the closest peer |

|

|

Full Year 2023 Outlook

The Company reaffirms its full year 2023 outlook of revenues between S$160 million and S$170 million and Adjusted EBITDA between S$11 million and S$15 million.

In the short term, the Company may be impacted by several factors outside of its control. These factors include actions by the government of Vietnam to rein in the availability of consumer credit, residual political uncertainty in Malaysia, property taxation and stamp duty increases in Singapore as a mechanism for prioritizing affordable home ownership for Singaporeans, a lack of clarity in global fiscal policy stemming from rising interest rates, greater inflationary pressures, and global supply chain issues. Longer-term, the Company remains bullish on its growth trajectory, prospects for improving profitability, and the fundamental opportunity that exists in our core markets.

Conference Call and Webcast Details

The Company will host a conference call and webcast on Wednesday, May 24, 2023, at 8:00 a.m. Eastern Standard Time / 8:00 p.m. Singapore Standard Time to discuss the Company's financial results for the first quarter of 2023 and full year 2023 outlook. The PropertyGuru (NYSE: PGRU) Q1 2023 Earnings call can be accessed by registering at:

https://propertyguru.zoom.us/webinar/register/WN_TlifVd2DS4SqGghTyijfvw

An archived version will be available on the Company’s Investor Relations website after the call at https://investors.propertygurugroup.com/news-and-events/events-and-presentations/default.aspx